Resources Connected TV

How to approach CTV advertising in 2025 with The Trade Desk

Select your country or region to see content tailored to your country.

Recruiting fraud is a growing issue for many companies.

The Trade Desk takes this issue seriously and is taking steps to address it.

Connected TV

The Trade Desk Intelligence recently released a report on Australian consumer and advertiser shifts to streaming TV in all its forms. The study shows that consumers are leading the movement to Connected TV (CTV), citing that 2.5 million Australians chose broadcast video on demand (BVOD) over linear TV – amounting to 26 million hours (about 2,966 years) of BVOD content watched every week. Read the full report to unpack what this means for the marketing industry.

The Trade Desk Intelligence recently released a report on Australian consumers and advertisers choosing streaming TV in all its forms: subscription video on demand (SVOD), broadcast video on demand (BVOD), advertising-based video on demand (AVOD), channels with free ad-supported streaming (FAST), social video, and linear TV. The report shows that consumers are leading the movement towards streaming TV, citing that 2.5 million Australians chose BVOD over linear TV every week, amounting to 26 million hours of BVOD content consumed per week.

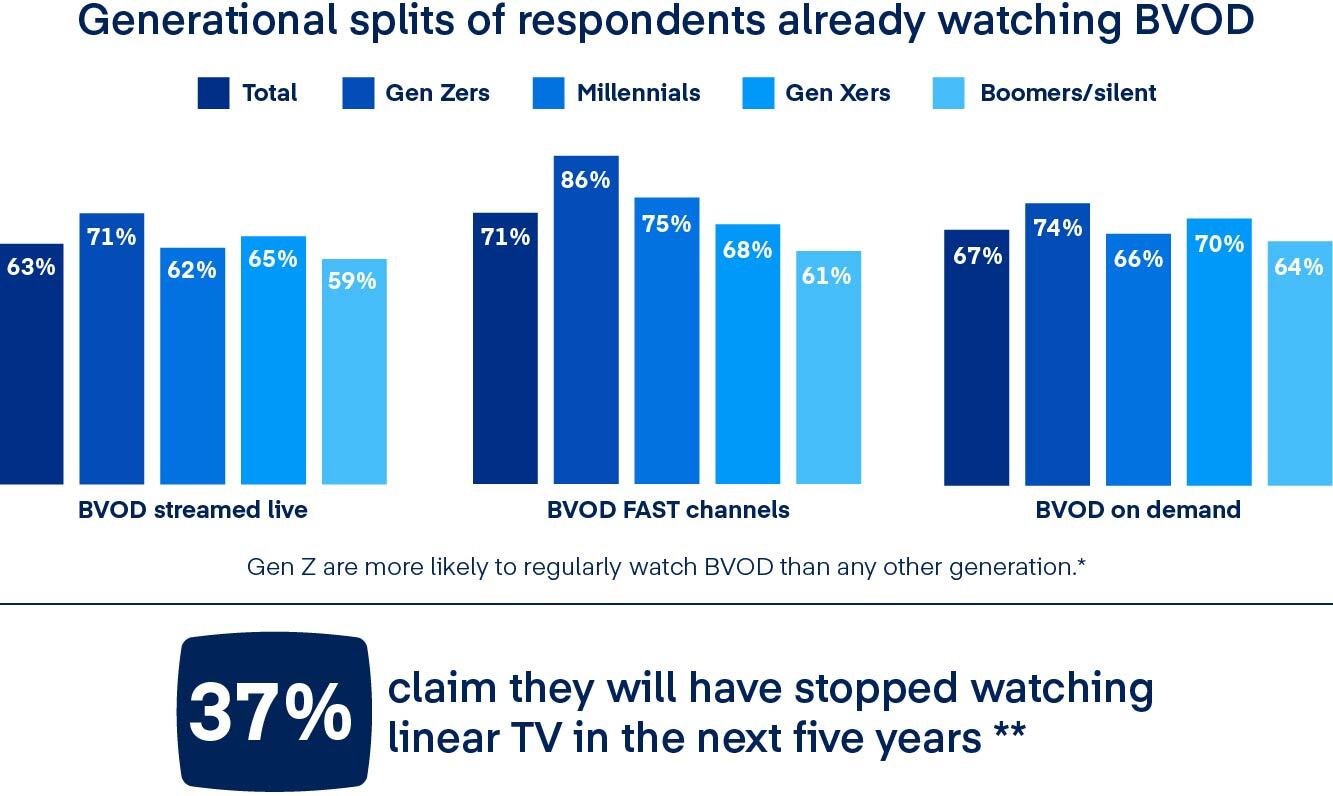

Unsurprisingly, Gen Z, often referred to as ‘digital natives’ due to their lifelong exposure to multiple screens and the online world, are at the forefront of reshaping viewing behaviours. Among the individuals surveyed who already engage with BVOD, Gen Z individuals emerged as the most consistent consumers. Thirty seven per cent of Australian Gen Z BVOD viewers anticipate ceasing their viewership of linear TV within the next five years. In addition, FAST channels have garnered attention from younger demographics. These channels provide a carefully curated, laid-back viewing experience that appeals to Gen Z’s growing preference for content discovery.

While the landscape (and the acronyms) have become more complex as streaming partners continue to enter the market, Australians are willing to follow the content by using an average of 2.3 paid TV subscriptions (including SVOD and paid TV). It has been reported, however, that they’re also keeping a close eye on household budgets; 36% of SVOD subscribers say they are open to ads in exchange for a free or reduced-cost subscription, with research from Deloitte showing that a whopping 44% of Australians claim that they are willing to consider six minutes of ads an hour for a subscription fee of $5 per month.

As these trends continue to evolve, how can you keep up and stay ahead of the changing landscape? By advertising on The Trade Desk, you can:

As you prepare to move to BVOD, here are some questions to ask yourself:

Wondering about how you can better engage consumers within the evolving streaming TV landscape in Australia? Download the full report or reach out to your account manager to find out more about buying streaming TV on The Trade Desk.

Resources Connected TV

Resources Connected TV

Resources Connected TV