Featured Our platform

Drive better outcomes with the latest platform innovations

Learn how you can take advantage of platform features to strategically plan, execute, and measure campaigns holistically.

Select your country or region to see content tailored to your country.

Recruiting fraud is a growing issue for many companies.

The Trade Desk takes this issue seriously and is taking steps to address it.

Best practices, how-to guides, insights, and inspiration for ad pros

Featured Our platform

Learn how you can take advantage of platform features to strategically plan, execute, and measure campaigns holistically.

The latest

Case Studies Our platform

Resources Connected TV

Case Studies Connected TV

Resources Our platform

Resources Omnichannel

Case Studies Our platform

Resources Omnichannel

Case Studies Omnichannel

Insights Omnichannel

A problem occurred, please try again later.

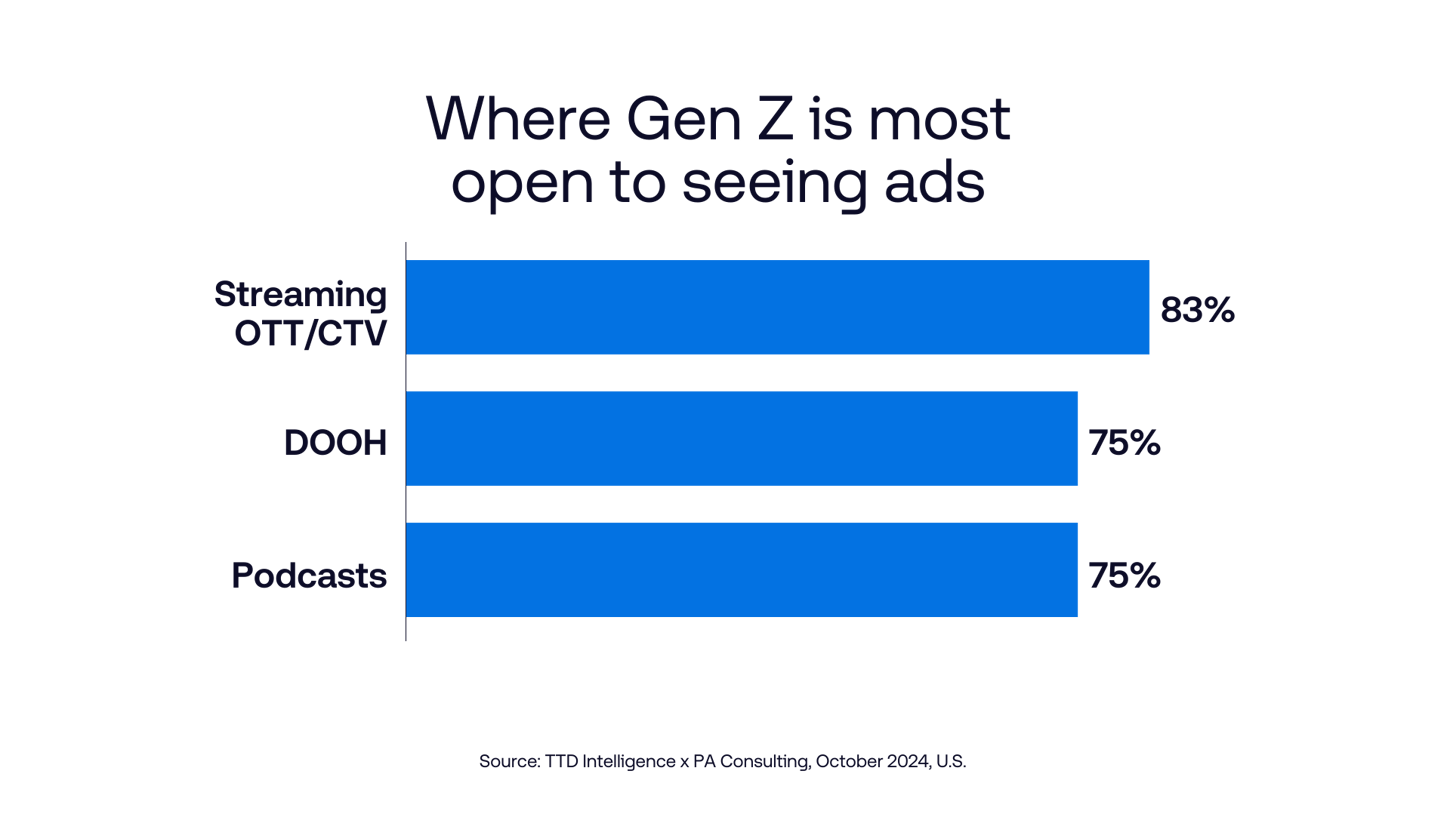

INSTANT INTELLIGENCE

Research reveals that Gen Z prefers ads on CTV over other digital channels. Our omnichannel report provides key insights and advertising tips on how to reach them.

Resources Our platform

Resources Our platform

Resources Our platform

Whether you’re a media planner, buyer, trader, or CMO, Edge Academy has all you need to get up to speed and stay ahead.